[He] isn’t worrying about the U.S. credit rating downgrade in the least. When asked about it in an interview with CNBC on Thursday, he said, “There are some things people shouldn’t worry about. This is one.”

There are a hundred lenses in which to view this event through, countless articles, and never ending opinions. This article highlighting a billionnare’s viewpoint stuck out to me in an online sea of similairty.

Buffett continues to bet heavily on the strength of the U.S. economy.

“U.S. Treasury bonds are widely viewed as the safest of safe-haven assets. But a leading credit rating agency doesn’t think that debt issued by the U.S. government is as safe as it used to be.

Last Tuesday, Fitch Ratings downgraded the credit rating for the U.S. to AA+ (very high credit quality) from AAA (highest credit quality). The move rattled the stock market, sending major market indexes lower.

Buffett isn’t worrying about the U.S. credit rating downgrade in the least. When asked about it in an interview with CNBC on Thursday, he said, “There are some things people shouldn’t worry about. This is one.”

That doesn’t mean, however, that Buffett doesn’t agree with some of Fitch’s reasoning behind its downgrade. The company cited the U.S. government’s growing debt and “steady deterioration in standards of governance over the last 20 years” as key factors for lowering the U.S. credit rating to AA+. Buffett acknowledged that those are valid concerns.

However, the legendary investor doesn’t think the stability of the U.S. or its financial system is in trouble. He told CNBC’s Becky Quick, “The dollar is the reserve currency of the world, and everybody knows it.”

Buffett is putting his money where his mouth is. In a CNBC interview earlier this year, he stated that Berkshire Hathaway buys U.S. Treasuries “every Monday.” Buffett reiterated on Thursday that’s exactly what the giant conglomerate will continue to do. He said, “[T]he only question for next Monday is whether we will buy $10 billion in three-month or six-month” U.S. Treasuries.”

Still the safest safe haven

“Even Fitch acknowledged that the U.S. has “exceptional strengths,” including its large economy and the status of the dollar as the world’s reserve currency. Buffett couldn’t have said it better himself.

U.S. Treasury bonds — especially those with short-term maturities — remain a great alternative for investors who seek dependable yields. That’s especially the case with the steep valuation of many stocks right now.

Buffett isn’t worried about the U.S. credit rating downgrade. Retail investors shouldn’t be, either. U.S. Treasury bonds are still arguably the safest of safe havens.”

The response to the U.S. debt downgrade

“Many policymakers took the news negatively, arguing that the resolution of the debt ceiling debate in the late spring was contrary evidence to the assertions that the government’s fiscal mechanisms were broken. Both the Treasury Department and the White House criticized Fitch for its decision.

Yet there was a definite delayed reaction in most financial markets. Stock index futures suggested a much smaller decline at the open of trading on Wednesday morning. Bond yields didn’t start moving upward in earnest until midmorning, pushing the rate on 10-year Treasuries to nearly 4.1%.

…

All in all, Fitch’s decision to downgrade U.S. government debt is likely more symbolic than meaningful. It only draws attention to trends that have been ongoing for years now.

Investors don’t need to pay much attention to the downgrade in and of itself. Most market participants have already acknowledged the structural challenges that the U.S. and other countries face in the current economy, and they’re likely to persist for some time unless Washington suddenly pays more attention to fiscal matters than it has up until now.”

Forget the Fed… Pay Off Your Credit Card Debt!

Feeling like you want to DO something instead of reading articles? Take personal repsonsiblity when it comes to your own debt ceiling and credit usage. Pay down credit card balances if you are able.

Ultimate Guide to Understanding Your Credit Score and Score Ranges

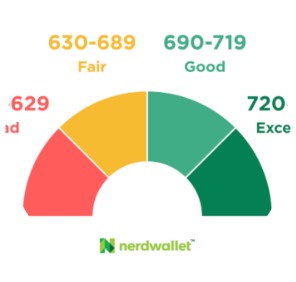

And just like our country, we’ve got a credit rating too. Dave Ramsey says buy in cash, but if you are looking to purchase a home with a mortgage… guess what: you need a credit score. And hopefully a good one at that.

I’m sure you’ve got a handle on it but just in case, here is a refresher on credit scores from nerdwallet.com.

Want to chat strategy about a potential property purchase or sale? Lets get on a quick call. Book here